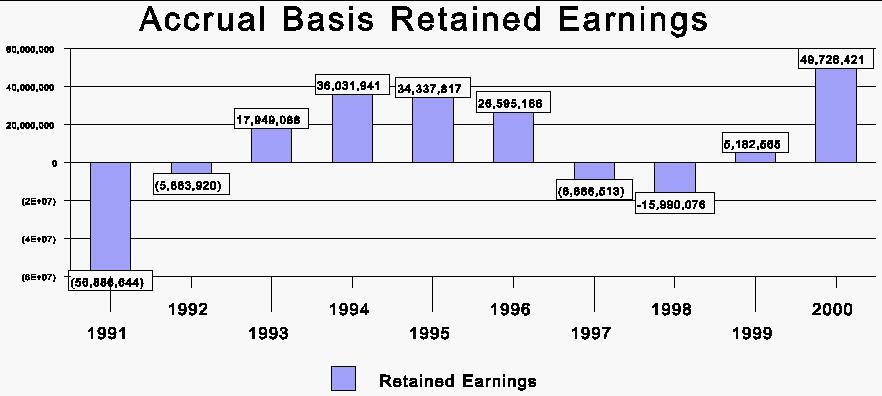

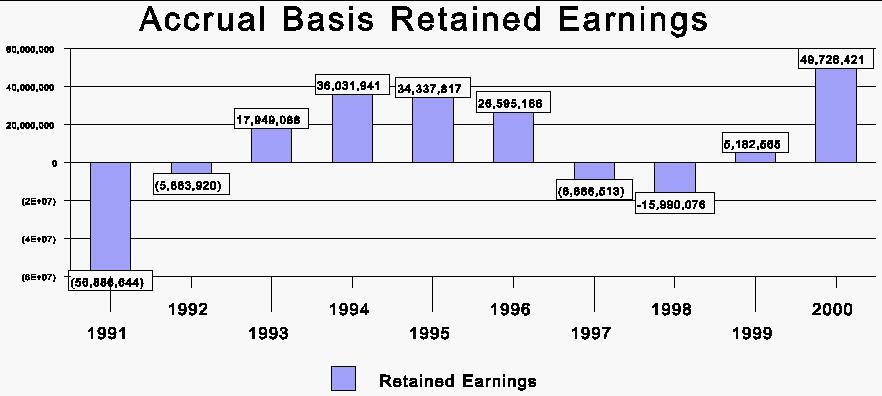

The Public Employees Insurance Agency (PEIA) Finance Board was created

in 1990 to eliminate a financial deficit of over $56 million, and to develop

financial plans providing financial stability for the agency. An important

element of financial stability is to avoid the recurrence of financial

deficits. Although the Board should be commended for eliminating the deficit

of 1990, the Board has not been successful in preventing a similar situation

to occur in 1997 and 1998 (see Figure 1). Although the deficits of 1997

and 1998 are not as large as that in 1990, the Legislative Auditor finds

that the Board has not provided financial stability to PEIA.

Causes for Financial Instability

This report identifies five causes for the financial instability; these are:

1) For most of the years from 1990, the Board did not develop balanced financial plans in which current expenses would be paid for by current revenues. Instead, the Board relied on existing surpluses to balance the financial plans.

2) The Board's financial planning lacks objectives that promote financial stability. No policy is established on whether or not to always have balanced financial plans, and how much of a surplus should be maintained at all times.

3) The Board is reluctant to raise premiums on employees and particularly retirees.

4) Retiree costs are growing at a faster rate than the State's contributions. This has put pressure on the Legislature to increase funding, or require PEIA to reduce the subsidization of retirees.

5) Employees' and retirees' utilization rates of PEIA's insurance may be high compared to other insurance plans. Not until 1998 did the Board begin to address utilization through increasing out-of-pocket expenses, deductibles, and co-payments. However, addressing utilization became necessary because the Board was faced with a financial deficit. Given that employees and retirees are charged a relatively low percentage of the costs, it stands to reason that this encourages a high utilization rate of various medical services.